Your Guide to PCI DSS Compliance

How DCS Keeps You Compliant and Secure

Contents

Introduction

PCI DSS More Than Just a Compliance Standard

Picture this: your business is thriving, your sales are up, and your customers are happy. But then, bam! A breach in your payment system. A hacker gains access to your customer’s credit card data. Suddenly, it’s not just about protecting your reputation, it’s about protecting your bottom line.

That’s where PCI DSS comes in. Whether you’re running a bustling retail shop in New York, or processing transactions for an online store, ensuring you meet the Payment Card Industry Data Security Standard (PCI DSS) is no longer a luxury, it’s a necessity. And here’s the best part: staying compliant doesn’t have to be a headache.

At Data Collaboration Services (DCS), we’re not just about checking off boxes for PCI DSS compliance; we make it seamless, manageable, and most importantly, secure for your business. Our team works proactively to ensure you’re not just meeting the bare minimum but staying ahead of emerging threats in the ever-evolving world of payment security.

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. It’s a set of comprehensive requirements designed to ensure that all companies who process, store, or transmit credit card information maintain a secure environment. Think of it as the universal “rulebook” for payment security. While it was developed by major credit card companies (Visa, MasterCard, American Express, etc.), it’s now a global standard that applies to businesses of all sizes and industries.

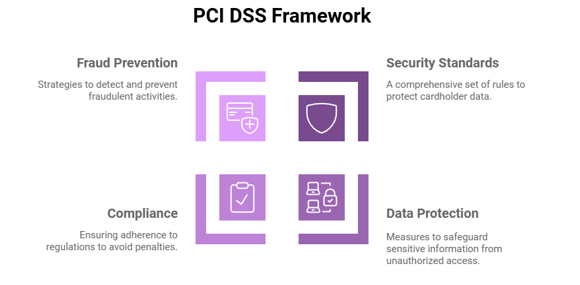

Here’s a quick breakdown of PCI DSS:

The Privacy Rule: This rule is focused on the protection of sensitive data. It’s about ensuring that cardholder information is kept safe from unauthorized access, whether that’s personal data or credit card details.

The Security Rule: This focuses on the technical and operational processes to protect cardholder data. This is where things like encryption, secure systems, and firewalls come in.

But PCI DSS isn’t just a list of rules. It’s your commitment to your customers’ security, your brand’s integrity, and your peace of mind.

Why Is PCI DSS Compliance So Crucial for Your Business?

Let’s face it: breaches happen. Cybercriminals are constantly coming up with new ways to target businesses, especially those handling credit card data.

- Penalties: Non-compliance with PCI DSS can result in fines up to $100,000 per month.

- Reputation Damage: A data breach can be a reputation killer. If your customers don’t feel their data is safe with you, they’ll find someone else who can protect them.

- Cost of a Breach: The average cost of a data breach in the U.S. is around $8 million, according to IBM.

But here’s the thing: it’s not all doom and gloom. Complying with PCI DSS not only helps you avoid penalties, but also protects your customers and builds trust. Your customers want to know their payment information is safe with you and meeting PCI DSS shows them you’re serious about their security.

How DCS Helps You Achieve and Maintain PCI DSS Compliance

At DCS, we don’t just check boxes, we strategically guide you through the PCI DSS compliance journey, making compliance feel like a natural extension of your business. Here’s how we help you become and stay PCI DSS compliant:

1. Tailored Risk Assessments

Understanding where you stand is the first step. We start by performing comprehensive risk assessments across your IT infrastructure, identifying vulnerabilities and recommending fixes. Our assessments provide the peace of mind that comes with knowing exactly what needs to be done to stay compliant.

2. End-to-End Data Protection

We make sure your payment data is encrypted and protected both at rest and during transmission. Through advanced encryption and firewall solutions, we ensure that customer payment information remains safe from unauthorized users. It’s about making sure that hackers can’t get into your network and mess with your data. Top-tier network security audits for you.

3. Ongoing Network Monitoring and Threat Detection

You’re busy running your business. Let us worry about your security. Our 24/7 network monitoring ensures that we’re constantly on the lookout for any suspicious activity. We proactively detect and prevent breaches before they escalate, so you can focus on what you do best, serving your customers.

4. Employee Awareness and Training

The human element is often the weakest link in security. That’s why we emphasize employee training on best practices for PCI DSS compliance. We teach your team how to spot phishing attempts, handle sensitive data securely, and protect themselves against cyber threats.

5. PCI DSS-Compliant Cloud Solutions

We offer cloud migration services that ensure your data is both secure and compliant with PCI DSS standards. Whether you’re moving to Microsoft Azure or adopting Office 365, our cloud solutions make sure your cloud environment is optimized for payment security.

6. Seamless Compliance Audits

PCI DSS requires regular audits. We help you prepare for both internal and external audits, ensuring all your systems, processes, and policies are in line with the latest standards. No more scrambling to get everything together when audit time comes around.

Key Components of PCI DSS Compliance

To help you get a better understanding of PCI DSS and what it entails, let’s break down the key components you’ll need to address:

Why DCS is Your Go-To Partner for PCI DSS Compliance

At DCS, we are compliant-friendly, we’re not just experts in PCI DSS, we’re experts in guiding you through the process with ease and confidence.

Here’s why DCS is your best choice for PCI DSS compliance:

- Expert Guidance: With years of experience and a team of certified security professionals, we offer expert advice on PCI DSS compliance, making it simple for you to follow best practices and avoid costly violations.

- Scalable, Tailored Solutions: Whether you’re a small business or a large enterprise, we create customized solutions that meet your specific needs, providing scalability and flexibility as your business grows.

- Proactive Compliance: Compliance doesn’t end once you pass the audit. We offer continuous monitoring, risk assessments, and training to ensure your systems remain secure, compliant, and always ahead of emerging threats.

Ready to Achieve PCI DSS Compliance with DCS?

Achieving and maintaining PCI DSS compliance doesn’t have to be a daunting process. Let DCS help simplify the process for you. With our proven security tools, expert guidance, and continuous monitoring, we ensure that your payment systems remain secure and your business stays compliant.

Frequently Asked Questions (FAQ's)

Non-compliance can lead to severe fines (up to $100,000 per month) and legal issues, not to mention a loss of reputation and customer trust.

The time varies depending on your systems and business size. However, DCS works efficiently to streamline the process, typically helping businesses become compliant within 3-6 months.

Yes! We help prepare your business for the PCI DSS audit, providing necessary documentation and guidance to ensure you pass with flying colors.

Compliance should be reviewed annually, with continuous monitoring in place to ensure ongoing security.

We implement end-to-end encryption, multi-factor authentication (MFA), firewall protection, and regular penetration tests to ensure your cardholder data is always secure.