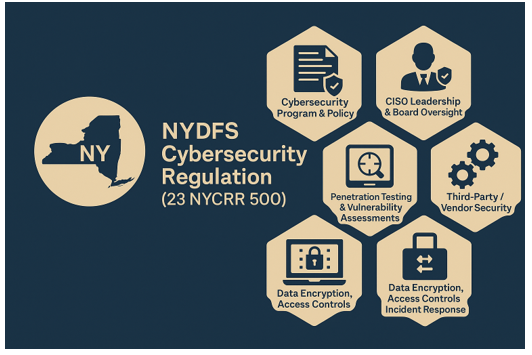

NYDFS Cybersecurity Regulation

What Businesses Need to Know About 23 NYCRR 500

Contents

Why NYDFS Awareness Matters

Cybersecurity isn’t a checkbox; it’s mandatory, especially for businesses operating in the financial sector. In New York, the Department of Financial Services (NYDFS) enforces one of the most comprehensive cybersecurity regulations in the United States: 23 NYCRR 500, often referred to simply as the NYDFS Cybersecurity Regulation.

This regulation, first enacted in 2017 and updated with amendments in 2023, requires covered entities such as banks, insurance companies, mortgage lenders, and financial service providers licensed in New York to establish and maintain robust cybersecurity programs.

Non-compliance isn’t just a regulatory risk. Fines, reputational damage, and even loss of licensure can result from failing to meet NYDFS standards. For businesses, awareness of NYDFS requirements is essential, not just to remain compliant, but to demonstrate resilience, trustworthiness, and accountability in the eyes of regulators, customers, and partners.

Though we’re not a regulatory body or a legal firm, we are fully aware of NYDFS cybersecurity requirements and align our IT and cybersecurity services with its principles. We can also provide consulting to clients who need help preparing for audits, implementing controls, or ensuring their IT systems meet NYDFS expectations.

What is the NYDFS Cybersecurity Regulation (23 NYCRR 500)?

The NYDFS Cybersecurity Regulation (23 NYCRR 500) establishes minimum cybersecurity standards for all financial services companies licensed or regulated by the New York Department of Financial Services.

Core Objectives

The regulation is designed to:

- Protect customer data against cyberattacks.

- Promote strong governance through executive accountability.

- Mandate risk-based security programs tailored to each organization.

- Strengthen resilience of New York’s financial sector against evolving threats.

Who Must Comply with NYDFS?

Any organization regulated by NYDFS falls under the scope of this regulation, including:

- Banks and credit unions.

- Insurance companies and agents.

- Mortgage lenders and brokers.

- Licensed virtual currency (crypto) businesses.

- Other financial service providers operating under NYDFS oversight.

Some small businesses (fewer than 10 employees, less than $5 million in gross annual revenue, or less than $10 million in total assets) may qualify for limited exemptions, but all entities must file compliance certifications or exemption notices annually.

Key Requirements of NYDFS Cybersecurity Regulation

The regulation outlines a detailed cybersecurity program structure. Here are the most critical requirements businesses must address:

Cybersecurity Program & Policies

- Develop and maintain a cybersecurity program that protects the confidentiality, integrity, and availability of IT systems.

- Establish written policies and procedures, approved by senior management or the board, covering data governance, access controls, application security, and more.

Chief Information Security Officer (CISO)

- Appoint a qualified CISO, either internal or outsourced, responsible for overseeing and enforcing cybersecurity policies.

- The CISO must report to the board or senior management at least annually on the state of the cybersecurity program.

Risk Assessments

- Conduct periodic risk assessments to identify and evaluate risks to data and systems.

- Risk assessments must inform security policies, controls, and monitoring efforts.

Access & Identity Management

- Implement least privilege principles.

- Require multi-factor authentication (MFA) for all remote access and privileged accounts.

Encryption of Data

- Encrypt non-public information (NPI) both in transit and at rest.

- Where encryption is not feasible, implement effective alternative compensating controls.

Incident Response & Reporting

- Establish a written Incident Response Plan (IRP).

- Report cybersecurity events to NYDFS within 72 hours of discovery.

Annual Certification

- Covered entities must file an annual certification of compliance with NYDFS by April 15 each year.

Monitoring & Testing

- Conduct continuous monitoring or annual penetration testing and bi-annual vulnerability assessments.

Third-Party Risk Management

- Implement policies and due diligence procedures for managing risks from vendors and service providers.

Amendments (2023 Enhancements)

The 2023 update introduced stricter requirements, such as:

- More detailed board-level oversight of cybersecurity.

- Enhanced logging and monitoring requirements.

- Faster remediation timelines for critical and high-risk vulnerabilities (e.g., 90 days, with extensions only by CISO approval).

- Stronger requirements for MFA, endpoint detection, and response.

Why NYDFS Compliance is Important

Awareness and compliance with NYDFS regulations is crucial for several reasons:

- Legal Requirement: It’s mandatory for all covered entities operating under NYDFS.

- Financial Penalties: Non-compliance fines can reach millions of dollars.

- Reputation & Trust: Financial institutions are prime targets for cyberattacks; compliance builds confidence with customers and investors.

- Regulatory Alignment: NYDFS overlaps with other frameworks such as NIST CSF, ISO 27001, and FFIEC guidelines, making compliance a foundation for broader cybersecurity readiness.

How DCS Can Support NYDFS Awareness & Consulting

While DCS is not a certifying or regulatory body, we help clients align their IT infrastructure and practices with NYDFS principles.

Here’s how we can support your business:

Risk Assessments & Gap Analysis

- Evaluate your IT systems against NYDFS requirements.

- Identify vulnerabilities and recommend mitigation strategies.

CISO-as-a-Service Guidance

- Assist organizations in establishing governance structures and CISO reporting practices.

Policy & Documentation Support

- Help draft or refine cybersecurity policies, IRPs, and vendor risk procedures.

Encryption & Access Controls

- Implement technical safeguards like encryption, MFA, and secure logging.

Incident Response Readiness

- Develop IRPs and test your response procedures.

- Provide tabletop exercises to prepare for real-world events.

Vendor & Third-Party Risk Oversight

- Review vendor contracts and assess compliance with NYDFS expectations.

Audit & Certification Preparation

- Guide businesses in preparing for annual certifications and audits.

Benefits of Aligning with NYDFS Cybersecurity Regulation

Even beyond avoiding fines, compliance brings tangible benefits:

- Reduced Risk: Lower likelihood of breaches and costly data loss.

- Business Continuity: Stronger resilience against ransomware and disruptions.

- Customer Confidence: Transparent security practices improve client trust.

- Competitive Edge: Demonstrates maturity to investors, partners, and regulators.

Industry Use Cases

- Banks & Credit Unions: Protect customer deposits and transactions.

- Insurance Companies: Secure policyholder and claims data.

- Mortgage Lenders: Protect sensitive borrower financial records.

- Crypto & FinTech Firms: Demonstrate compliance in a high-risk, high-growth sector.

Takeaway

The NYDFS Cybersecurity Regulation (23 NYCRR 500) is one of the strictest data protection frameworks in the U.S., setting the standard for financial services cybersecurity. For businesses, it’s not just a regulatory hurdle, it’s a roadmap to resilience, trust, and security.

At Data Collaboration Services (DCS), we help clients navigate NYDFS requirements by aligning IT infrastructure, risk management, and data protection strategies with regulatory expectations. While we don’t certify compliance, we ensure your business is better prepared for audits, breach prevention, and long-term trust.

Frequently Asked Questions (FAQ's)

NYDFS 23 NYCRR 500 is a cybersecurity regulation that mandates financial institutions in New York establish robust programs to protect sensitive data.

All banks, insurance firms, mortgage companies, and other financial services organizations regulated by NYDFS.

Originally in 2017, with key amendments in 2023.

Penalties can be millions of dollars per violation and include reputational damage.

Some small businesses may qualify for exemptions, but they must still file exemption notices annually.

Covered entities must submit an annual certification of compliance by April 15.

No, DCS is not a certification body. However, we follow NYDFS principles in our IT services and can consult with clients to help them align with regulatory expectations.

NYDFS shares many controls with NIST CSF, ISO 27001, and FFIEC, making compliance a foundation for broader regulatory readiness.